Home Ownership: How It’s Changing Across America

The quest for homeownership in America has reached critical levels of affordability crisis, with many regions witnessing soaring prices that have strained the budgets of many potential homeowners. A recent report from Realtor.com highlights the stark contrasts between different metro areas, underscoring where aspiring homeowners might still find respite amid a generally turbulent market.

Thriving Cities for Potential Homeowners

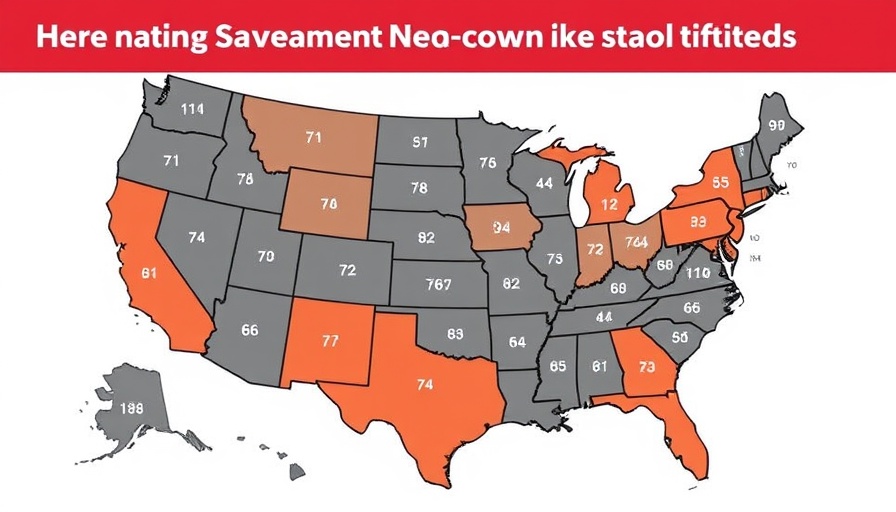

The Realtor.com report reveals that two metropolitan areas stand out for their surprising affordability: Pittsburgh and Detroit. Households in Pittsburgh spend approximately 27.4% of their pre-tax income on housing costs, while Detroit follows closely at 29.8%. These figures are a breath of fresh air compared to the overall average of 44% across the nation. St. Louis rounds out the trio with a housing cost of exactly 30% of household income.

Anthony Djon, a luxury real estate expert, points out that despite rising home prices, Detroit remains accessible to median-income earners. The city represents one of the last major markets where aspirational homeowners still have a fighting chance. As demand surges in lower price brackets, first-time buyers are acting quickly to secure homes before prices escalate even further.

The Burden of High Housing Costs

On the flip side, cities such as Los Angeles and San Jose starkly contrast with the affordability found in Pittsburgh and Detroit. In these expensive metros, households are grappling with impending financial burdens. For instance, households in Los Angeles would need to spend more than double their income on housing, a clear indicator of the challenging landscape faced by potential buyers.

Furthermore, in cities like San Diego and New York, homebuyers are required to allocate over 60% of their income to housing expenses, amplifying the growing fears of buyers who long for stability in a tumultuous market.

Understanding the Trends in Home Affordability

Danielle Hale, chief economist at Realtor.com, emphasizes the urgent need for change. "Earnings may have seen increases, but they seem to lag behind the steep rise of homebuying costs," she stated. This imbalance calls for urgent adjustments in housing supply and interest rates to ensure that homeownership remains feasible.

Other cities showing moderate affordability include Cleveland, Indianapolis, Birmingham, Baltimore, and Buffalo, yet even these markets face challenges as housing costs tick towards the critical threshold. These locales provide a near solution for median-income households willing to consider employment relocations.

Conclusive Thoughts and Future Outlook

The landscape of homeownership is shifting dramatically as data showcases either steep affordability barriers or significant opportunities for potential buyers. Homeownership may still be attainable, especially in regions demonstrating lower housing costs. However, this respite is not uniform across the nation, and vigilance is necessary for both buyers and real estate agents alike. With first-time buyers eager to seize opportunities in affordable metros, professionals in the real estate sector must adapt swiftly to help clients navigate these challenging waters effectively.

As the housing market continues to evolve, keeping an eye on trends and local markets will ensure that real estate agents can provide their clients with the most informed guidance possible.

If you’re a real estate agent, residual opportunities to assist clients exist in these affording metros. They are hot spots in a market that is both competitive and compelling. Understanding your local market against national trends will better equip you to serve your clients well.

Add Row

Add Row  Add

Add

Write A Comment