Bill Pulte’s Unconventional Approach to the FHFA

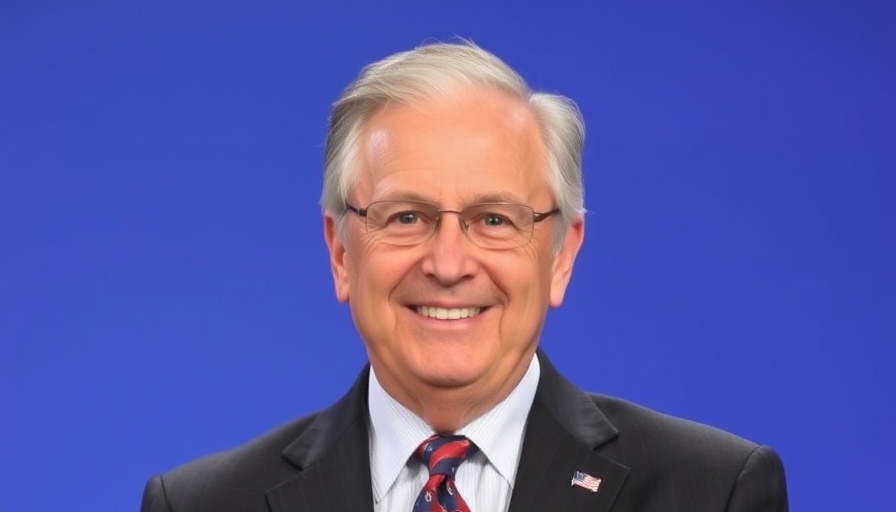

Since taking on the role of director at the Federal Housing Finance Agency (FHFA), Bill Pulte has emerged as a somewhat radical figure, pushing the boundaries of what one might expect from a governmental regulator. His tenure began with swift and decisive actions, including the removal of 14 board members from the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. This bold move was emblematic of Pulte's broader intention to scrutinize and reform the FHFA to meet contemporary challenges in the housing finance system.

His Background and Initial Moves Spark Curiosity

Pulte's background as a member of a prominent family that founded one of the nation’s largest homebuilding firms offers him unique insights into the housing market. This pedigree, combined with his philanthropic endeavors through social media, has garnered him a significant following. His rise in the political arena has been just as rapid; his preference for social media platforms to communicate directly with Americans diverges sharply from traditional governmental norms. In his early days, Pulte made headlines not just for his board changes but for his commitment to tackling issues like mortgage fraud, which he described as part of a broader strategy to enhance accountability within the GSEs.

Responses to Pulte’s Leadership Style

His leadership style has sparked conversations about accountability and transparency in public institutions. Critics have pointed to the rapid shifts in personnel as potentially destabilizing for the GSEs during a time when housing markets are still recovering from significant disruptions caused by the pandemic. However, supporters argue that such a clean sweep is necessary to introduce fresh perspectives and ideas, suggesting that stagnation could be more damaging than the volatility associated with leadership changes.

The Implications of Regaining Control Over GSEs

One of Pulte's most ambitious goals is bringing Fannie Mae and Freddie Mac out of conservatorship—a topic that has been discussed extensively without action for many years. This bold vision may reshape the landscape of home financing in the U.S. significantly. If successful, it could lead to renewed investment in housing markets and improved service delivery to borrowers. However, many question whether the changes can occur smoothly, especially given the intricacies involved in unwinding conservatorship.

Future Predictions: What Lies Ahead?

As the real estate landscape continues to evolve in the face of economic pressures and changing demographics, Pulte's tenure at the FHFA will be closely watched. His push for transparency and efficiency could be a double-edged sword. While these elements are beneficial, the challenge lies in ensuring that reforms do not compromise the security and accessibility of mortgage lending, particularly for first-time homebuyers.

For now, stakeholders in the housing market—including potential buyers, investors, and policymakers—should observe how Bill Pulte's leadership unfolds. His approach signals a departure from tradition that could either revive the GSEs or introduce new complexities into an already strained system.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment